With Examples to Save $$$ on your Property Taxes

One of the most common questions I get during open houses is: “What are the property taxes on this home?” Buyers are often surprised to see some homes with unusually low tax rates and some with much higher taxes. When purchasing property in Hawaii, it’s essential to understand how property taxes work—and how they can vary significantly depending on how the home is used.

Hawaii is unique in many ways, and its property tax system is no exception. Whether you’re a homeowner, investor, or someone considering agricultural use, knowing your tax classification can lead to significant savings—or surprises. Let’s break it down.

Hawaii Has the Lowest Property Taxes in the Nation for Homeowners

One of the most attractive aspects of owning a primary residence in Hawaii is the low property tax rate. According to national data, Hawaii has one of the lowest average property tax rate in the U.S.—typically under 0.30% of assessed value. For homeowners who qualify for the Homeowner Exemption, this means real savings.

Each island sets its own property tax rates and exemptions, but qualifying for the homeowner classification can often reduce your assessed value by half or more, depending on the county, and place you in the lowest property tax rate bracket.

Homeowners Exemption Example

For example, on the Big Island (Hawai‘i County), the standard homeowner exemption reduces your property tax rate from $11.55 (per $1,000 of assessed value) to $5.95 (per $1,000). Even greater exemptions are available for those age 60 and older, with rates improving as you age. I love that Hawai‘i County takes care of our kūpuna (our respected elders) by further reducing their property taxes. Plus, you’ll also benefit from the 3% assessment cap on future property value increases!

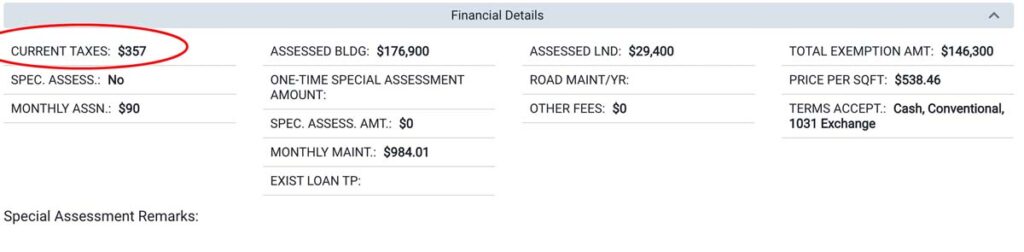

Attached is a screenshot from the Multiple Listing Service showing the property tax for a homeowner selling their condo in Waikoloa Village at Fairway Terrace. The current property tax amount is $357.

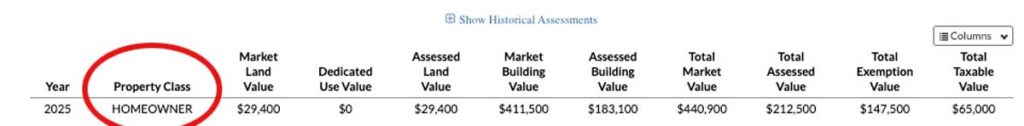

You can also search the County of Hawai‘i public records for any property, which will show the homeowner’s classification—for example, ‘Homeowner Status’—indicating they qualify for the homeowner exemption and the lower property tax rate. These records also display the County’s assessed value of the property, which is used to calculate annual property taxes. The County of Hawai‘i reassesses property values approximately every 12 months.

To qualify for this exemption:

- The property must be your primary residence (more than 200 Calendar days)

- You must file a claim with the county Real Property Tax office

- Your name must appear on the deed

- You must apply on or before December 31 or June 30

- You must file your taxes with the State of Hawaii within the past or the next 12 months

This is a crucial step for new buyers to take after closing.

Investment Property Tax Rates Are Higher

If the property is not your primary residence—meaning it’s used as a vacation rental, second home, or long-term rental—you will be taxed at a higher rate. These are considered non-owner-occupied or investment properties, and the tax classifications reflect the higher potential revenue-generating use.

On the Big Island, for instance:

- Residential (non-owner-occupied) and residential investor properties are taxed at a higher rate of $11.10 (per $1,000 of assessed value) for properties valued under $2 million and $13.60 for properties valued over $2 million.

- Hotel/Resort classification—properties used for short-term rental (Airbnb and VRBO)—carries the rate of $11.70.

If you’re planning to use your Hawaii property as an investment, it’s wise to factor these higher annual property tax costs into your budget and ROI calculations.

None-Homeowner Exemption Example:

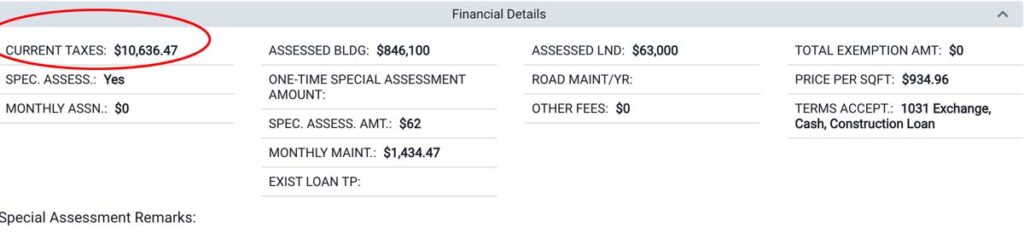

I currently have a condo listed for sale in Waikoloa Beach Resort at Vista Waikoloa, owned by a nonresident of Hawai‘i and used as a second home. Attached are the current annual property tax records for this property.

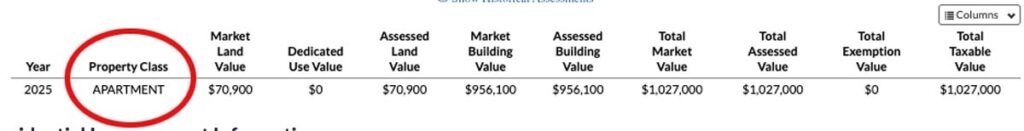

You can also view public records from the County of Hawai‘i, which show the property is classified as ‘Apartment’—a designation that results in significantly higher tax rates compared to a homeowner classification. This status carries a rate of $11.70 (per $1,000 of assessed value) which explains the current annual property tax of $10,636.47. If you scroll further down the page, you’ll see the history of property tax rate increases, with a noticeable spike beginning in 2023—following the island’s largest real estate boom since 2006.

Agricultural Zoned Land

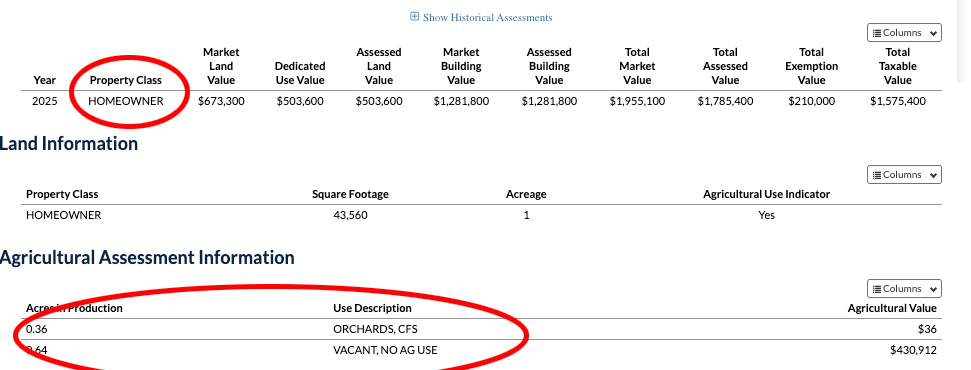

For buyers considering larger parcels of land, homes with 1 acre+ or farms, Hawaii also offers Agricultural use assessments. These can significantly lower your tax burden—if you meet the requirements.

Agricultural classification is based not only on zoning but also on active use of the land for approved farming purposes. Owners must file a dedication petition and periodically submit income or activity reports to keep the status.

There are a few ways non-homeowners can receive an agricultural discount on their property taxes. One example is leasing the land to a farmer who uses the land for grazing their livestock. Other qualifying uses include maintaining an orchard, whether with large or small trees, or even beekeeping.

While many people associate Hawai‘i with beaches, it’s important to remember that we have a strong agricultural community rooted in farming, livestock, and vegetable production.

Key Takeaways for Buyers and Homeowners

- Apply for the Homeowner Exemption as soon as possible after closing to lock in the lowest tax rate.

- Understand your intended use of the property—primary residence vs. rental vs. agricultural—because it directly affects your tax classification.

- Keep in mind that each county in Hawaii has its own tax rates and deadlines, so always double-check with the appropriate Real Property Tax office (Hawai‘i, Maui, O‘ahu, or Kaua‘i). https://www.hawaiipropertytax.com/tax_rates.html

Final Thought: Low Taxes, High Value

While Hawaii’s real estate market is often seen as expensive, its exceptionally low property taxes for homeowners help offset the cost of ownership over time. Whether you’re looking for a full-time home, a vacation retreat, or an investment opportunity, understanding Hawaii’s property tax structure will help you make informed, financially sound decisions.